Avoiding Elder Financial Abuse: A Legal Guide for Families in Massachusetts & New Hampshire

As our loved ones age, their vulnerability to financial exploitation can increase—especially when cognitive decline or isolation is involved. Elder financial abuse is a growing problem, and it can come from strangers, caregivers, or even family members. Fortunately, there are legal strategies that families in Massachusetts and New Hampshire can use to protect aging relatives.

🔍 What Is Elder Financial Abuse?

Elder financial abuse occurs when someone illegally or improperly uses an older adult’s money, property, or assets. It can take many forms, including:

-

Unauthorized withdrawals or charges

-

Forged checks or power of attorney misuse

-

Pressure to revise estate plans

-

Investment or insurance scams

-

Telemarketing and phishing frauds

According to the National Council on Aging, elder financial abuse costs older Americans over $36 billion annually—and most cases go unreported.

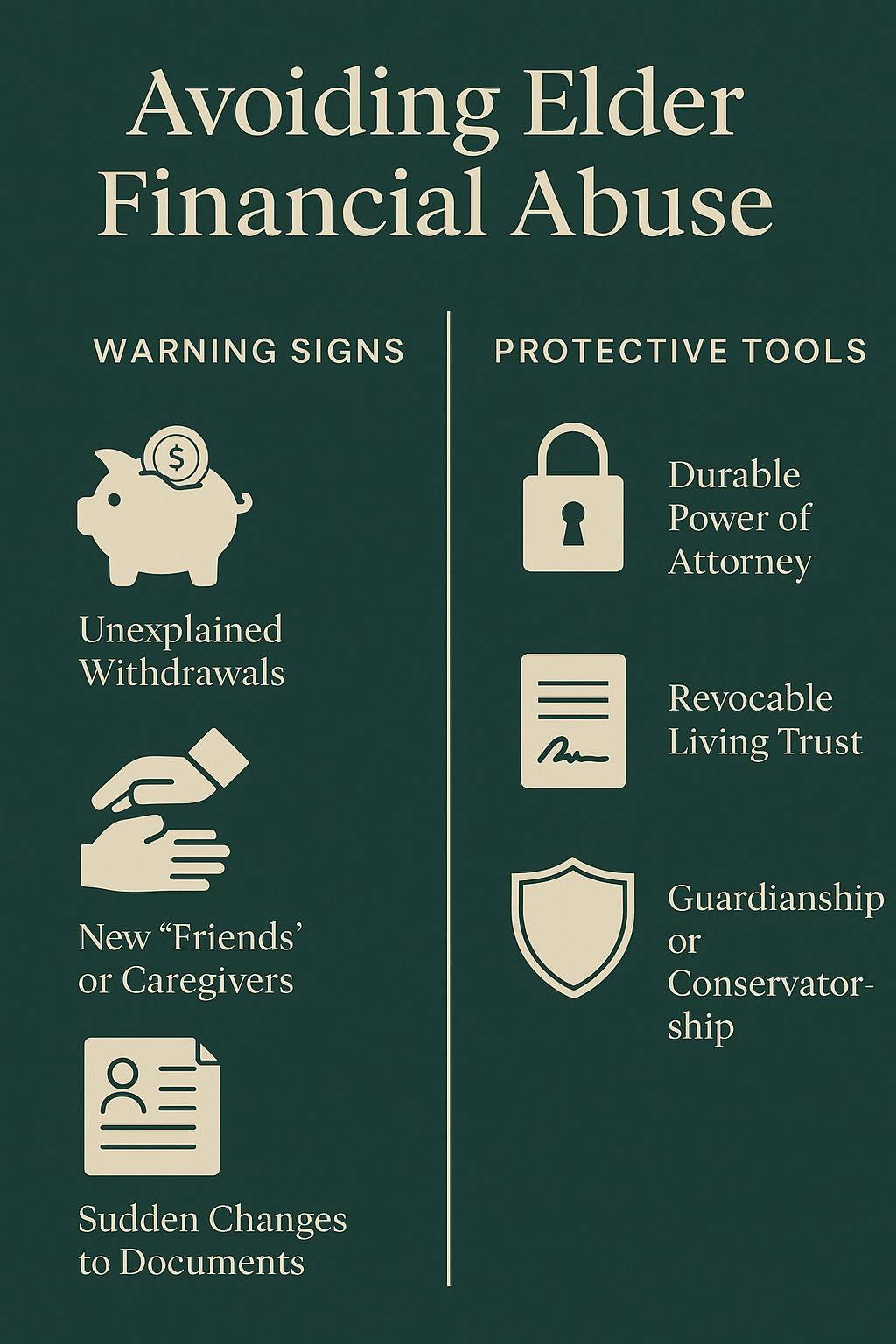

🚩 Common Warning Signs to Watch For

It’s not always easy to detect financial abuse, but the following red flags may signal something is wrong:

-

Sudden changes to a will or trust

-

Unexplained withdrawals or wire transfers

-

A new "friend" or caregiver controlling access

-

Missing property or unpaid bills

-

Fear, anxiety, or confusion when discussing finances

Trust your instincts—if something seems off, it likely deserves attention.

⚖️ Legal Tools to Prevent Elder Financial Abuse

Families can take several proactive steps to reduce the risk of exploitation:

1. Durable Power of Attorney (POA)

This document allows a trusted person (the agent) to handle legal and financial matters if the elder becomes incapacitated. It should be:

-

Specific and customized—not generic online templates

-

Reviewed regularly to ensure it's up to date

-

Drafted with clear limitations and oversight mechanisms

2. Revocable Living Trust

A trust can safeguard assets by placing them under the management of a responsible trustee. It also avoids probate and offers more privacy and control.

3. Guardianship and Conservatorship

In more severe cases, the court can appoint someone to manage an elder’s affairs. This is typically a last resort but is essential when abuse is already occurring or capacity is fully lost.

4. Health Care Proxy & HIPAA Authorization

These allow family members to stay informed about an elder’s health status and participate in care decisions—which often intersect with financial concerns.

5. Bank Oversight and Alerts

Help your loved one set up spending alerts or give limited account viewing access to detect suspicious activity early.

🧠 Education and Open Communication

Beyond legal tools, the most effective prevention is early education and family communication. Encourage open discussions about financial planning before a crisis arises, and include an attorney when necessary.

👩⚖️ How Integrative Legal Can Help

At Integrative Legal, we take a holistic and compassionate approach to elder law. We don’t just draft documents—we help families navigate difficult transitions and protect their loved ones with dignity and care.

Serving families in Massachusetts and New Hampshire, we can help you:

-

Create protective legal documents

-

Respond to suspected financial abuse

-

Mediate family concerns and build consensus

-

Coordinate with financial institutions and medical providers

📞 Take the First Step Toward Protection

If you’re worried about a loved one—or planning ahead for yourself—don’t wait until something goes wrong. Legal planning is one of the strongest defenses against elder exploitation.